Quantitative Asset Management Software

About the Client

The client is a quantitative money management firm in the USA, With almost $8.5+ billion in assets and an investment track record of 22+ years. They deliver a broad range of equity portfolios, including Custom Indexes, to institutional advisors, individual investors, and the high-net-worth clients of financial advisors. They also manage mutual funds in the United States and serve as a sub-advisor to a family of Canadian mutual funds through the Royal Bank of Canada.

CASE STUDIES

Business/Client Challenges

The client’s senior management team had a rather extensive list of improvements needed in the existing technologically enabled investment platform. The client’s current tech team struggled to keep up with the new requirements and maintain the existing platform. This meant the loss of revenues for the client. UI for the tool also needed to be reconceptualized.

The client decided to collaborate with Dynamisch’s experienced Microsoft .Net MVC framework team with their technical team as an extended arm of developers to develop striking new features in an existing application.

Skills/Tools Used:

- ASP. NET MVC with razor UI

- DevExpress advance UI and Grid controls

- Kendo UI controls

- Bootstrap 3

- jQuery

- TFS

- Azure DevOps

- MS SQL Server

Dynamisch Approach

- Our team of Project Managers and Business Analysts conducted a series of meetings to understand the pain point in the SDLC, followed by the client’s team.

- Dynamisch assigned an expert .NET MVC developers team to understand the complete infrastructure and code structure to understand what exists.

- Dynamisch first concentrated on making the tool secure by fixing the security issues in the existing code.

- Dynamisch team also met with senior management to understand the planned improvements and new features.

- Based on the observation, Dynamisch suggested the modules and process modification better manage the assets and HNI’s expectations.

- Dynamisch delivered well-constructed models that are more likely to do well in an uncertain future than complicated models that are perfectly prepared for the past.

- Dynamisch restructured both the front and backend of the new financial asset management solution, which incorporated the following features required by the client’s teams:

- New extended revamped module for investing and disciplined strategies.

- Portfolio management system with significant factor advantages in distinctive style segments, market capitalization ranges, and geographic regions.

- Tool for the client to conduct market research and present the finding in an easily readable way to the investors.

- A Robust Solution to generate custom reports in minimal clicks.

Results

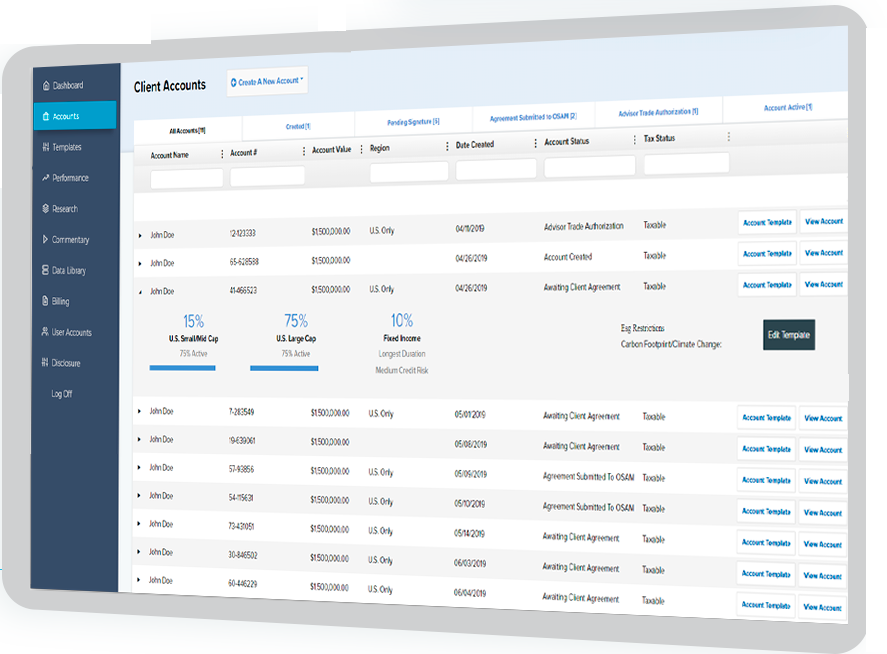

The new client’s financial asset management solution included a deep level of customization in strategies that clients and advisors can build. Digital Paperwork, easy onboarding, and the ability to retain the firm’s existing investment philosophy. A robust solution designed by Dynamisch allowed the client to achieve the following:

-

- Reporting tools helped immensely when an advisor was interacting with a prospect, allowing them to close the clients in 50% less time.

- State-of-the-art data sorting algorithms result in the improved daily activity of gathering customer information in a single instance

- Revamped best-in-class UI for the most intuitive strategy interface.

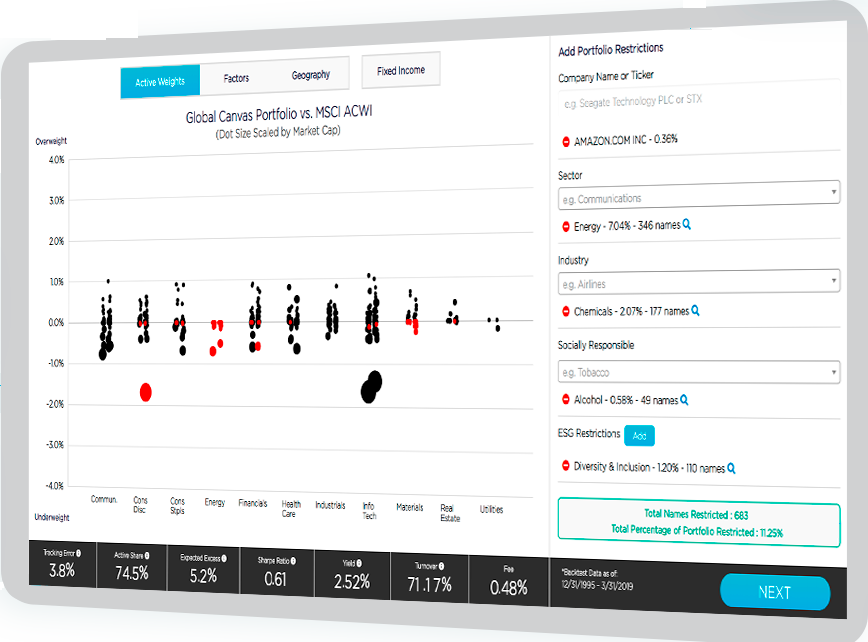

- Ability to view portfolio exposure based on selection (Active Weights, factors, geography)

- Instant feedback on the selection made by investors based on historical data.

- Ability to see the impact on portfolio characteristics in real time.

- Ability to restrict the portfolio by ticker, sector, industry, or through multiple ESG and SRI avenues.

- Paperless account creation, account performance, portfolio management, and trading on rebalancing all through a single platform.

- The tool has become the best in the industry in custom indexing investment strategy.

Using the new revamped updated tool allowed the client to accomplish outstanding financial outcomes. The recent financial asset management tool directly impacted bringing new assets and HNIs to the platform.